Due to a Vimeo protocol change, striped video thumbnails have replaced the original images of the oldest recordings:

click on the striped video thumbnails to watch the videos.

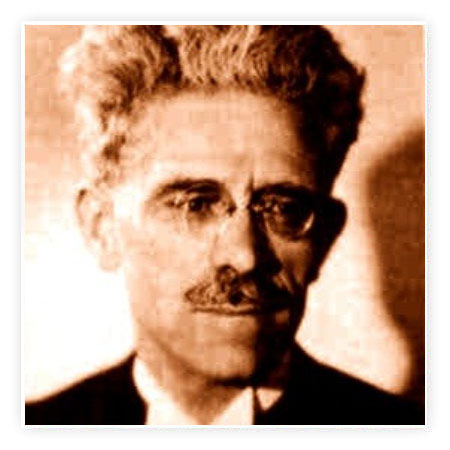

CONFERENCE IN HONOR OF ROBERT BOYER

CELEBRATING 60 YEARS OF THE THEORIE DE LA REGULATION

Paris

Co-organization with the International Labour Organization, the OFCE and the University of Geneva

Speakers: Michel Aglietta (CEPII), Bruno Amable (Université de Genève), Benoît Bazin (Saint-Gobain), Robert Boyer (Institut des Amériques/Centre Cournot), Christophe Clerc (Descartes Legal), Giovanni Dosi (Scuola Superiore Sant'Anna), Ekkehard Ernst (ILO), Agnès Labrousse (SciencesPo Lyon), Thomas Lamarche (Université de Paris), Frédéric Lordon (EHESS), Nelo Magalhães (LADYSS), Sandrine Michel (Université de Montpellier), Sabine Montagne (Université Paris Dauphine), Mary O’Sullivan (Université de Genève), Stefano Palombarini (Université Paris 8), Xavier Ragot (OFCE), Laurence Scialom (Université Paris Nanterre), Évelyne Serverin (Université Paris Nanterre), Bruno Théret (Université Paris Dauphine).

Programme:

- Capitalism as an Analytical Tool: What Have You Learned from Your Research?

- Does the Opposition between Capital and Labour Continue to Structure Contemporary Societies?

- Transformations in Capitalism: Modes of Work and Corporate Management

- Why Be a régulationniste Today? (Debate)

- Transformations in Capitalism: The Stabilities and Instabilities of Finance-Induced Capitalism

- Does the Issue of the Environment Imply a New Role for the State? Is the State an Institutional Form Like Any Other?

- Théorie de la Régulation: Past, Present, Future

Sorbonne Université

Amphithéâtre Louis Liard

17, rue de la Sorbonne

Paris 5ème

Conference commemorating the 50th anniversary of Frechet's death

Paris

Organized in collaboration with the LPSM of Sorbonne University and the Institut Henri Poincaré

http://conferencefrechet2023.fr

Institut Henri Poincaré

11 rue Pierre et Marie Curies

75005 Paris

The modeling of markets with complex and rough regimes

Visioconference

SLOAN CONFERENCE

Organized with École polytechnique and the University of California at Irvine

PROGRAM - PRESENTATIONS - VIDEOS

WEDNESDAY, 31 AUGUST 2022

Welcome and Introduction to the Conference

Jean-Philippe Touffut (Fondation Cournot) and

Josselin Garnier (École Polytechnique)

PART 1 - Chaired by David Mordecai (Courant Institute, NYU)

The fractional Brownian motion in volatility modeling

Elisa Alòs (Universitat Pompeu Fabra, Barcelona)

This talk focuses on the properties of volatilities driven by the fractional Brownian motion (fBm) or

related processes. In particular, we study the short-end behaviour of the at-the-money level, skew and

curvature of fractional volatilities, and we see how this behaviour is more consistent with real market

data.

Rough volatility: Fact or artefact?

Rama Cont (University of

Oxford)

Based on joint work with Purba Das

We investigate the statistical evidence for the use of "rough" fractional processes with Hurst exponent H<0.5 for the modeling of volatility of financial assets, using a model-free approach. We introduce a non-parametric method for estimating the roughness of a function based on a discrete sample, using the concept of normalized p-th variation along a sequence of partitions. We investigate the finite sample performance of our estimator for measuring the roughness of sample paths of stochastic processes using detailed numerical experiments based on sample paths of fractional Brownian motion and other fractional processes. We then apply this method to estimate the roughness of realized volatility signals based on high-frequency observations. Detailed numerical experiments based on stochastic volatility models show that, even when the instantaneous volatility has diffusive dynamics with the same roughness as Brownian motion, the realized volatility exhibits rough behaviour corresponding to a Hurst exponent significantly smaller than 0.5. Comparison of roughness estimates for realized and instantaneous volatility in fractional volatility models with different values of Hurst exponent shows that, irrespective of the roughness of the spot volatility process, realized volatility always exhibits "rough" behaviour with an apparent Hurst index Ĥ <0.5. These results suggest that the origin of the roughness observed in realized volatility time series lies in the estimation noise rather than the volatility process itself.

A GMM approach to estimate the roughness of stochastic volatility

Mikko Pakkanen (Imperial College London)

I present an approach to estimate log normal stochastic volatility models, including rough volatility

models, using the generalized method of moments (GMM). In this GMM approach, estimation is done directly

using realized measures (e.g., realized variance), avoiding the biases that arise from using a proxy of spot

volatility. I also present asymptotic theory for the GMM estimator, lending itself to inference, and apply

the methodology to Oxford–Man realized volatility data. This presentation is based on joint work with Anine

Bolko, Kim Christensen and Bezirgen Veliyev.

PART 2 – Chaired by Knut Sølna (University of California at Irvine)

Quadratic Gaussian models: Analytic expressions for pricing in rough volatility models

Eduardo Abi Jaber (Université Paris I)

Stochastic models based on Gaussian processes, like fractional Brownian motion, are able to reproduce

important stylized facts of financial markets, such as rich autocorrelation structures, persistence and

roughness of sample paths. This is made possible by virtue of the flexibility introduced in the choice of

the covariance function of the Gaussian process. The price to pay is that, in general, such models are no

longer Markovian nor semimartingales, which limits their practical use. We derive explicit analytic

expressions for Fourier–Laplace transforms of quadratic functionals of Gaussian processes. Such

analytic expression can be approximated by closed form matrix expressions stemming from Wishart

distributions. We highlight the applicability of such results in the context of rough volatility modeling:

(i) fast pricing and calibration in the (rough) fractional Stein–Stein model; (ii) explicit solutions for

the Markowitz portfolio allocation problem in a multivariate rough Stein—Stein model.

Efficient inference for large and high-frequency data

Alexandre

Brouste (Université du Maine)

Although a lot of attention has been paid to the high-frequency data due to their increasing availability

in different applications, several statistical experiments under the high-frequency scheme remain not fully

understood. For instance, at high frequency, the variance and the Hurst exponent for the fractional Gaussian

noise (fGn) or the scale and the stability index for the stable Lévy process are melting. Weak LAN property

with a singular Fisher information matrix was obtained for the fGn and for the stable Lévy

process.

Due to this singularity, no minimax theorem can be applied and it has been unclear for a long time whether the maximum likelihood estimator (MLE) possesses any kind of asymptotic optimality property. More recently, we established a non-singular LAN property for the fGn and for the stable Lévy process making it possible to define the asymptotic optimality in these statistical experiments.

The LAN theory does not directly provide the construction of efficient estimators. In regular statistical experiments, the MLE generally achieves optimality. Nevertheless, its computation is time consuming, and alternatives should be found to handle big or high-frequency datasets available in the fields of insurance and finance. In this direction, the Le Cam one-step estimation can be proposed in the aforementioned statistical experiments (and in others).

Time-inhomogeneous Gaussian stochastic volatility models: Large deviations and super

roughness

Archil Gulisashvili (Ohio University)

The talk concerns time-inhomogeneous stochastic volatility models in which the volatility is described by

a non-negative function of a Volterra type continuous Gaussian process that may have very rough sample

paths. We prove small-noise large deviation principles for the log-price process in a Volterra type Gaussian

model under very mild restrictions. These results are used to study the small-noise asymptotic behavior of

binary barrier options, exit time probability functions, and call options.

Concluding remarks

THURSDAY, 1 SEPTEMBER 2022

PART 3 – Chaired by Jean-Philippe Touffut (Fondation Cournot)

Rough volatility: Challenges for Macroeconomists

Xavier Timbeau

(OFCE)

Rough volatility and regime shifts: Views from a macroeconomist

Jean-Bernard

Chatelain (Université Paris I)

The presentation focuses on rough volatility on stock market returns, endogenous persistence and regime shifts with feedback from other variables.

Concluding Remarks

Josselin Garnier (École Polytechnique), Knut Sølna (University of California at Irvine), Jean-Philippe Touffut (Fondation Cournot)

- En savoir plus // PDF & Videos

-

• Introduction

• Elisa Alòs (Universitat Pompeu Fabra, Barcelona)

The fractional Brownian motion in volatility modeling - Elisa Alòs

• Mikko Pakkanen (Imperial College London)

A GMM approach to estimate the roughness of stochastic volatility - Mikko Pakkanen

• Eduardo Abi Jaber (Université Paris I)

• Alexandre Brouste (Université du Maine)

Efficient inference for large and high-frequency data - Alexandre Brouste

• Archil Gulisashvili (Ohio University)

Multivariate Stochastic Volatility Models and Large Deviation Principles - Background paper

• Xavier Timbeau (OFCE)

Rough volatility: Challenges for Macroeconomists - Xavier Timbeau

• Jean-Bernard Chatelain (Université Paris I)

Rough volatility and regime shifts: Views from a macroeconomist - Jean-Bernard Chatelain

• Concluding remarks

EUROPE SUPPORTING YOUNG RESEARCHERS IN TIMES OF UNCERTAINTY

Visioconference

Participation in the 4th Gago Conference on European Science Policy

The Impact of the Crises on Early-Career Researchers: Which Data Should Be retained and How Should They Be Interpreted?

Jean-Philippe Touffut (Centre Cournot)

https://www.cienciaviva.pt/gagoconf/4th-edition#programme

FROM MICROSCOPIC MODELS TO ROUGH MACROSCOPIC MODELS

Visioconference

SLOAN CONFERENCE: Price regimes

Organized with École Polytechnique and the University of California at Irvine

In recent years, non-Markovian modeling has received a lot of attention in pure and applied financial modeling. It is of fundamental and practical interest to understand how such non-Markovian, or fractional behavior, as observed on a macroscale, can arise as a result of stated models on the microscale. Such analysis bears similarities, but also differences, to the analysis of physical systems from a scaling limit perspective. This conference will present some aspects of the process of understanding rough macroscale behavior as a result of certain microscopic dynamics.

Program

Quadratic Hawkes processes: A microfoundation for rough volatility models?

Jean-Philippe Bouchaud (Capital Fund Management/École polytechnique)

We discuss a natural generalization of the Hawkes processes that accounts for a feedback from past price trends and volatility onto current activity. The model naturally explains the power-law nature of price returns and the violation of time reversal invariance. It can be extended in various directions, in particular to model the activity in the order book and the occurrence of liquidity crises.

From no-arbitrage to rough volatility via market impact

Mathieu Rosenbaum (École polytechnique)

Market impact is the link between the volume of a (large) order and the price move during and after the execution of this order. We show that under no-arbitrage assumption, the market impact function can only be of a power-law type. Furthermore, we prove that this implies that the macroscopic price is diffusive with rough volatility, with a one-to-one correspondence between the exponent of the impact function and the Hurst parameter of the volatility. Hence, we simply explain the universal rough behavior of the volatility as a consequence of the no-arbitrage property. From a mathematical viewpoint, our study relies, in particular, on new results about hyper-rough stochastic Volterra equations.

Modeling rough covariance processes

Christa Cuchiero (University of Vienna)

The rough volatility paradigm asserts that the trajectories of assets’ volatility are rougher than Brownian motion, a revolutionary perspective that has changed certain persistent views of volatility. It provides via stochastic Volterra processes a universal approach to capture important features of time series and option price data, as well as microstructural foundations of markets. We provide an infinite dimensional point of view on stochastic Volterra processes, which makes it possible to dissolve a generic non-Markovanity of the at-first-sight naturally low dimensional volatility process. This approach makes it possible to go beyond the univariate case and to treat multivariate rough covariance models, in particular of affine and Wishart type, for more than one asset.

VISIOCONFERENCE

- More // PDF & Videos

-

• Introduction

• Jean-Philippe Bouchaud (Capital Fund Management/École polytechnique)

• Mathieu Rosenbaum (École polytechnique)

From no-arbitrage to rough volatility via market impact - Mathieu Rosenbaum - 02-02-2022

• Christa Cuchiero (University of Vienna)

Modeling rough covariance processes - Christa Cuchiero - 02-02-2022

KICK-OFF CONFERENCE: FRACTIONAL CALCULUS IN FINANCE

Visioconference

Sloan Grant Conference Series

Organized with École polytechnique and the University of California at Irvine

SESSION 1 – 11:00 am - 12:30 pm (New York) / 5:00 - 6:30 pm (Paris)

Introduction to the project and the conference

Josselin Garnier (École polytechnique), Knut Sølna (University of California at Irvine) and Jean-Philippe Touffut (Cournot Centre)

Excursion Risk: Linking properties of price paths with the analysis of dynamic trading strategies

Rama Cont (University of Oxford)

Discussion

12:30 - 1:30 pm (New York) / 6:30 - 7:30 pm (Paris) - BREAK

SESSION 2 – 1:30 - 3:00 pm (New York) / 7:30 - 9:00 pm (Paris)

The pricing conundrum of rough volatility

Antoine Jacquier (Imperial College London)

Endogenous regime shifts of persistence

Jean-Bernard Chatelain (Paris School of Economics)

Discussion

Closing remarks

VISIOCONFERENCE

- More // Video

-

Introduction to the project and the conference

• Rama Cont (University of Oxford)

• Antoine Jacquier (Imperial College London)

• Jean-Bernard Chatelain (Paris School of Economics)

Insights from US Antitrust Enforcement History (1918-1941) for Competition Law and Economics in Times of Crisis

VISIOCONFERENCE

5:00 – 5:10 pm (11:00 – 11:10 am): Introduction: Antitrust during times of crisis and the lessons from the interwar period

Frédéric Marty (CNRS, Université Côté d’Azur)

5:15 – 5:35 pm (11:15 – 11:35 am): The issue of Bigness in Antitrust enforcement: Were structural remedies a solution?

Naomi R. Lamoreaux (Yale University)

Paper: "The Problem of Bigness: From Standard Oil to Google", Journal of Economic Perspectives, 33(3), Summer 2019, pp.94-117.

5:40-6:00 pm (11:40 am – 12:00 pm): From the War Industries Board to the National Industrial Recovery Act: A US model of regulated competition?

Thierry Kirat (CNRS; Université Paris Dauphine)

Paper by Thierry Kirat and Frédéric Marty: "From the First World War to the National Recovery Administration (1917-1935): The Case for Regulated Competition in the United States between the Wars"

6:05 – 6:15 pm (12:05 – 12:15 pm): Framing Antitrust as Public Interest Law, 1890 till 1960

Dina Waked (Sciences Po Law School)

Paper: “Antitrust as Public Interest Law: Redistribution, Equity, and Social Justice”, The Antitrust Bulletin, 65(1), 2020, pp. 87–101.

6:20 – 6:40 pm (12:20 – 12:40 pm): The antitrust policy of the 2nd New Deal (1938): Arguments for free competition

Spencer Weber Waller (Institute for Consumer Antitrust Studies, Loyola University Chicago)

Paper: "The Antitrust Legacy of Thurman Arnold", Saint John's Law Review, 78, 2004, pp.569-614.

6:45 – 7:05 pm (12:45 – 1:05 pm): Is the concentration of economic power a risk to democracy?

Daniel Crane (University of Michigan)

Paper: “Facism and Monopoly”, Michigan Law Review, 118(7), 2020, pp.1315-1370.

7:10 – 7:20 pm (1:10 – 1:20 pm): Concluding Remarks

Robert Boyer (Cournot Centre; Institute of the Americas)

VISIOCONFERENCE

- More // PDF & Video

-

Naomi R. Lamoreaux (Yale University)

The issue of bigness in antitrust enforcement - Naomi R. Lamoreaux - 08-12-2020

• Thierry Kirat (CNRS; Université Paris Dauphine)

From the War Industries Board to the National Industrial Recovery Act - 08-12-2020

• Dina Waked (Sciences Po Law School)

• Spencer Weber Waller (Institute for Consumer Antitrust Studies, Loyola University Chicago)

The Antitrust Legacy of Thurman Arnold - Spencer Weber Waller - 08-12-2020

• Daniel Crane (University of Michigan)

Fascism and Monopoly - Daniel Crane - 08-12-2020

• Robert Boyer (Cournot Centre; Institute of the Americas)

• Discussion

Conference in honour of Nicole El Karoui

Sorbonne University - ParisCo-organization of the conference held in honour of Nicole El Karoui – a pioneer of mathematics applied to finance – for her 50 years of scientific contributions. The four-day conference began with a day dedicated to Women in Science (WiSE), co-sponsored by the Cournot Centre and Foundation. The event marked the launch of the Cournot programme – geared towards a young audience – to promote the role of women in the development of probability theory and the advancement of their contributions.

Math en Jeans National Conference

SaclayAs part of its Initiation to Probability program for middle-school students from Priority Education networks (REP) in France, the Cournot Foundation sponsored students from the Collège des Petits Ponts in Clamart, near Paris, to attend the annual national conference of the association Math en Jeans at CentraleSupélec Higher Education and Research Institution in Saclay. The students had a stand, presenting the methods and results of their work on the game of maximum.

Mathematical Economics after WWI

CIRM Marseille Within the framework of the conference commemorating the end of WWI: Mathematical Communities in the Reconstruction after the Great War (1918–1928)

Michel Armatte (Alexandre Koyré Center): Economic Cycles: From Descriptive Statistics to Formalization

Irina Konovalova-Peaucelle (French National Centre for Scientific Research - CNRS): Was the Russian Theory of Cycles a Mathematical Theory?

Pierre-Charles Pradier (University Paris I): Were the Foundations of Measurement without Theory Laid in the 1920s?

https://conferences.cirm-math.fr/1850.html

- More // PDF & Video

-

Michel Armatte (Centre Alexandre Koyré)

2018-11_Michel_Armatte_Presentation.pdf

Irina Konovalova-Peaucelle (CNRS)

2018-11_Irina_Peaucelle_Presentation.pdf

Pierre-Charles Pradier (Université Paris I)

2018-11_Pierre-Charles_Pradier_Presentation.pdf

International Conference on Economic and Financial Risks

Niort

Participation in the international conference organized by IRIAF (Institute of Industrial, Insurance and Financial Risk) and CRIEF (Research Centre on Economic and Financial Integration), both of the University of Poitiers

Cournot Centre speakers:

Nicole El Karoui (Sorbonne University)

Longevity Risks: A Brief Overview of the State of Our Knowledge

Knut Sølna (University of California at Irvine/École Polytechnique; Cournot scholar 2017-2018)

On Memory, Regimes and Risk

Fractional Processes in Finance

Organized by École polytechnique - Palaiseau

Plenary speakers:

Eduardo Abi Jaber (Université Paris-Dauphine)

Lifting the Heston Model

Elisa Alòs (Universitat Pompeu Fabra, Barcelona)

The Short-Time Behavior of the Implied Volatility for Fractional Volatilities

Alexandre Brouste (Université du Maine)

Parametric Estimation in Self-Similar Processes at High Frequency

Omar El Euch (École polytechnique)

Multi-Factor Approximation of Rough Volatility Models

Archil Gulisashvili (Ohio University)

Volterra-Type Fractional Stochastic Volatility Models

Blanka Horvath (Imperial College, London)

Learning Rough Volatility

Antoine Jacquier (Imperial College, London)

Volatility Options in Rough Volatility Models

Josef Teichmann (ETH, Zurich)

Generalized Feller Processes and Markovian Lifts of Stochastic Volterra

Processes: The Affine Case

What’s Happening on World Energy Markets?

New York Hosted by the Alfred P. Sloan Foundation , New York

- More // PDF & Video

-

AGENDA

MORNING SESSION (9:30 am – 11:30 am)

Welcome and Introduction to the Conference

Round Table – What’s Been Happening on Energy Markets?

Chaired by Robert Solow (MIT; Cournot Centre)

Michael Levi (Former Special Assistant to President Obama for Energy and Economic Policy)

Antoine Halff (Center on Global Energy Policy, Columbia University)

Presentation Antoine Halff_031017.pdf

Amy Myers Jaffe (Energy Security and Climate Change Program, Council on Foreign Relations)

Presentation Amy Myers Jaffe_031017.pdf

Lutz Kilian (University of Michigan)

Presentation Lutz Kilian_031017.pdf

Discussion

- LUNCH -

AFTERNOON SESSION (1:00 pm – 3:00 pm)

How to Model the Roughness of Oil and Gas Dynamics

Josselin Garnier (Ecole Polytechnique) &Knut Sølna (University of California, Irvine):

A Time-Frequency Analysis of Oil Price Data

Presentation_Josselin Garnier - Knut Solna_031017.pdf

Commentator: Gérard Ben Arous (New York University)

Commentator: Lutz Kilian (University of Michigan)

Discussion_Lutz Kilian_031017.pdf

Discussion

Closing Remarks

CONFERENCE SUMMARY

What can we say about the evolution of oil and gas prices?

The conference will address this issue by:

(i) presenting tools that can be used to describe the complex multi-scale structures of energy-market price data;

(ii) discussing the possible mechanisms behind these regime shifts;

(iii) considering the possible implications for hedging and risk assessment.

A special focus will be put on the evolution of prices since the end of 2014.

The observation of market price fluctuations sometimes reveals behaviors that cannot be well captured by standard models based on discrete-time random walks or continuous diffusion. In standard models, the return fluctuations of a risky asset are driven by Brownian motion, giving independent Gaussian returns. It has become clear that oil and gas price data vary at different interconnected scales, slow or fast: they have a complicated multi-scale structure that, moreover, may vary over time. Time-frequency analysis can be used to identify the main features of these variations and, in particular, the regime shifts. The analysis derives from a wavelet-based decomposition, a special decomposition of a signal in time-frequency components, and the associated scale spectrum. The joint estimation of the local Hurst coefficient (an index of smoothness) and volatility is the key to detecting and identifying regime shifts and changes in the oil price. For the first time since 1986, "persistence" processes of unprecedented force occurred between the end of 2014 and 2016, opening up a new period.

Conference celebrating the centennial of the birth of Kiyosi Itô

Kiyosi Itô’s Legacy from a Franco-Japanese Perspective

Ambassade de France au Japon - Tokyo Ambassade de France au Japon , salle de réunion de l’atrium, 1F 4-11-44 Minami Azabu, Minato-ku, Tōkyō, 106-8514

- 7 minutes from the metro station Hiroo (Exit 1) - Access map : https://www.ambafrance-jp.org/Plan-d-acces-a-l-Ambassade

Organized by L'Institut des Hautes Études Scientifiques and Fondation et Centre Cournot

Contributors: Jean-Pierre Bourguignon (Institut des Hautes Études Scientifiques), Nicole El Karoui (École polytechnique), Masatoshi Fukushima (Osaka University), Tadahisa Funaki (University of Tokyo), Josselin Garnier (Université Paris Diderot), Daniel Goroff (Alfred P. Sloan Foundation), Shigeo Kusuoka (University of Tokyo), Glenn Shafer (Rutgers Business School), Jean-Philippe Touffut (Cournot Centre)

Due to security checks at the Embassy, please bring a photo I.D. and plan to arrive 20 minutes before the conference begins.

Presentations in English.

The work of Kiyosi Itô and the Japanese school of stochastic processes that he founded is exceptional both in its beauty as pure mathematics and in the insights it has provided in biology, chemistry, quantum physics, electrical engineering, and finance. As the International Mathematical Union attested in awarding Itô its first Carl Friedrich Gauss prize in 2006, his work ranks as part of the world’s cultural heritage.

From its outset, however, Itô’s work has stood in a special relationship to French mathematicians. The first citation in Itô’s published work, in fact, the first sentence of his first article, was to Paul Lévy’s, Théorie de l’addition des variables aléatoires . As Itô later wrote, he learned stochastic processes from this book. His goal was to make fully mathematical the beautiful structure the book depicted, and he succeeded. It is often said that other French mathematicians understood Lévy only after Itô had explained his contribution. Thirty years later, in the 1970s, Itô was still interacting with French mathematicians, embracing and further developing Paul-André Meyer’s semimartingale-based version of Itô’s theory of stochastic integration. Today, French mathematicians remain among those most keen to develop the applications of Itô’s calculus in physics and finance.

This conference examines Itô’s legacy from the perspective of this relationship. Is the theory of stochastic processes now truly a theory of sample paths as Lévy had envisioned? What has made Lévy processes and Itô’s understanding of stochastic integration so fruitful for applications in physics and finance? Where is Itô’s legacy taking us today?

- Read More // PDF & Video

- Thursday, 26 November 2015

10:30 am – Opening Session

• Glenn SHAFER (Rutgers Business School)

Whither Kiyosi Itô’s reconciliation of Lévy (betting) and Doob (measure)?

Shafer Presentation - Nov 2015.pdf

12:00 pm – Lunch

1:30 pm – Session 1: Itô’s Heritage

• Masatoshi FUKUSHIMA (Osaka University)

The Life and Mathematical Legacy of Itô Sensei

Fukushima Presentation - Nov 2015.pdf

• Daniel GOROFF (Sloan Foundation)

Abstraction vs. Application: Itô’s Calculus, Wiener’s Chaos, and Poincaré’s Tangle

Goroff Presentation - Nov 2015.pdf

3:00 pm – Coffee break

3:30 pm – Session 2: Itô and Stochastic Analysis

• Tadahisa FUNAKI (University of Tokyo)

Some Topics in Stochastic Partial Differential Equations

Funaki Presentation - Nov 2015.pdf

• Josselin GARNIER (Université Paris Diderot - Centre Cournot)

Itô's Calculus in Physics and Stochastic Partial Differential Equations

Garnier Presentation - Nov 2015.pdf

Friday, 27 November 2015

10:30 am – Session 3: Itô’s Calculus and Financial Applications

• Nicole EL KAROUI (École polytechnique)

What Makes Kiyosi Itô Famous on Trading Floors?

El Karoui Presentation - Nov 2015.pdf

• Shigeo KUSUOKA (University of Tokyo)

Itô Calculus, Malliavin Calculus and Finance

Kusuoka Presentation - Nov 2015.pdf

12:00 pm – Closing Remarks

• With the support of:

Ambassade de France au Japon

Japan Science and Technology Agency (CREST)

The Mathematical Society of Japan (MSJ)

Financing Science, or Innovation? Lessons from Europe, Japan and the U.S.

Ministère de la Recherche - Amphithéâtre Stourdzé - 1, rue Descartes, Paris 5eSpeakers: Jean-Louis Beffa (Centre Cournot), Jean-Pierre Bourguignon (European Research Council), Daniel Goroff (Sloan Foundation), Yuko Harayama (Japanese Council for Science, Technology and Innovation), Thibaut Kleiner (European Commission), Julia Lane (American Institutes for Research), Beth-Anne Schuelke-Leech (Ohio State University), Robert Solow (MIT)

- Read More // PDF & Video

- 9:15 am: Welcome and Introduction to the Conference

9:30 am: The Financing and Allocation of Innovation: Directions, Indicators and Incentives

• Thibaut Kleiner , European Commission

• Julia Lane , AIR

Julia Lane Presentation 29-09-2014

11 am: Coffee break

11:30 am: Venture Capital, Philanthropy and Public Financing

• Daniel Goroff , Sloan Foundation

Goroff Presentation 29-09-2014 (1.8 MiB)

• Beth-Anne Schuelke-Leech , Ohio State University

Schuelke-Leech Presentation 29-09-2014 (1.7 MiB)

1 pm: Buffet lunch

2:30 pm: Implications and Policy Conclusions for Governments and for Private Actors

• Jean-Pierre Bourguignon , European Research Council

Bourguignon Presentation 29-09-2014 (612.4 KiB)

• Yuko Harayama , Japanese Council for Science, Technology and Innovation

Harayama Presentation 29-09-2014 (760.2 KiB))

Are There Limits to the Probabilization of Science?

The Pappalardo Room, 4-349, Department of Physics, MIT, Cambridge, MA Organized with Harvard Medical School

Speakers: Noureddine El Karoui (UC, Berkeley), Josselin Garnier (University Paris VII), Alice Guionnet (MIT), Andreas Hilfinger (Harvard), Jonathan Le Roux (MERL), Johan Paulsson (Harvard)

- Read More // PDF & Video

- This conference brings together renowned probabilists from diverse scientific fields – probability theory, biology, geophysics, linguistics. By comparing definitions and methods, they assess the advance of probability in their respective disciplines and throughout the sciences as a whole. How do these disciplines intersect or diverge? Is there a common research agenda? What are the next steps in the development of probability?

Part I 10 am – 12 pm: The Advance of Probability: How Far Has It Come?

• Noureddine el Karoui (UC, Berkeley), The Relationship between Probability and Statistics

• Alice Guionnet (M.I.T.), Progress in Random Matrices

• Johan Paulsson (HMS), Defining a Stochastic Research Agenda in Systems Biology

Part II 1:30 – 3:30 pm: The Probability Approach

• Jonathan Le Roux (MERL): The Probabilization of Machine Perception in Speech and Audio

• Andreas Hilfinger (HMS): Understanding Biological Systems by Analyzing Stochastic Fluctuations

• Josselin Garnier (Université Paris-VII): Is a Common Agenda for Applied Probabilists Possible?

The Limits of the Probabilization of Science

Warren Alpert Building (room 536), 200 Longwood Avenue, Harvard Medical School, Boston (Longwood station) Chaired by Robert Solow (MIT)Speakers: Rémi Catellier (University of Paris IX), Meriem El Karoui (Harvard), Josselin Garnier (ENS), Andreas Hilfinger (Harvard), Johan Paulsson (Harvard).

What’s Right With Macroeconomics?

Les Miroirs - La Défense Jean-Louis Beffa (Saint-Gobain), Robert Boyer (CEPREMAP) , Jean-Bernard Chatelain (Université Paris I), Wendy Carlin (University College London), Giancarlo Corsetti (University of Cambridge), Giovanni Dosi (Sant’Anna School of Advanced Studies, Pisa) , Robert Gordon (Northwestern University), Paul de Grauwe (Université de Louvain), Gerhard Illing (Ludwig-Maximilians-Universität, Munich) , Xavier Ragot (CNRS), Willi Semmler (New School for Social Research, New York) , Robert Solow (MIT), Xavier Timbeau (OFCE), Volker Wieland (Goethe Universität, Frankfurt)

Conference volume: What’s Right with Macroeconomics?

2010 Conference Programme (75.8 KiB)

- Read More // PDF & Video

- Thursday, 2 December

1. A Panorama of Concepts and Approaches

• Jean-Bernard Chatelain (Université Paris I)

Presentation Jean-Bernard Chatelain (131.6 KiB)

• Xavier Timbeau (OFCE)

Presentation Xavier Timbeau (327.4 KiB)

• Giancarlo Corsetti (University of Cambridge)

Presentation Giancarlo Corsetti (290.0 KiB)

Commentator : Gerhard Illing (Ludwig-Maximilians-Universität, Munich)

Presentation Gerhard Illing (530.4 KiB)

Questions and Answers

2. Alternative Programmes: Renewing Macroeconomics

• Giovanni Dosi (Sant’Anna School of Advanced Studies, Pisa)

Presentation Giovanni Dosi (578.5 KiB)

• Xavier Ragot (CNRS)

Presentation Xavier Ragot (214.2 KiB)

Commentator : Willi Semmler (New School for Social Research, New York)

Presentation Willi Semmler (659.5 KiB)

Vendredi, 3 décembre

3. Rethinking the Role of Fiscal Policy

• Volker Wieland (Goethe Universität, Frankfurt)

Presentation Volker Wieland (652.3 KiB)

• Paul de Grauwe (Université de Louvain)

Presentation Paul de Grauwe (1.1 MiB)

Commentator : Robert Boyer (CEPREMAP)

Presentation Robert Boyer (390.3 KiB)

Questions and Anwers

4. Round Table: Where Do We Stand? chaired by Robert Solow (MIT)

Introduction

• Wendy Carlin (University College London)

Presentation Wendy Carlin (1000.6 KiB)

• Robert Gordon (Northwestern University)

Presentation Robert Gordon (183.9 KiB)

Conclusion by Robert Solow (MIT) &Jean-Louis Beffa (Saint-Gobain)