Due to a Vimeo protocol change, our site is undergoing maintenance.

Click on the striped targets to watch the videos.

Can the "German Model" be ajusted ?

on the OFCE premises

14:00 - 14:15

Introduction: Is Europe ailing from Germany?

Xavier Timbeau (OFCE), Jean Philippe Touffut (Cournot Centre)

14:15 - 15:15

The geopolitical environment and the German model

H.-Helmut Kotz (Harvard University), Xavier Timbeau (OFCE)

15:15 - 15:30

Coffee break

15:30 - 16:30

Employment issues and policy perspectives

Ekkehard Ernst (ILO), Jeanne Fagnani (Université Paris I)

How Can Banks Take into Account Climate Risk in Their Lending Portfolio?

Visioconference

Panel discussion on the Climate Extended Risk Model (CERM)

with Josselin Garnier (École Polytechnique) and Anne Gruz (Iggaak)

- More // PDF & Videos

- •

Introduction

• Anne Gruz (Iggaak)

ECONOMIC OUTLOOK 2021

Visioconference

Based on the contributions of:

Xavier Timbeau (OFCE),

Hans-Helmut Kotz (Goethe University / Harvard University) with Ekkehard Ernst (ILO)

Bernard Gazier (Université Paris I / Centre Cournot)

Robert Boyer ( Institut des Amériques / Centre Cournot)

- More // PDF & Videos

- •

Xavier Timbeau (OFCE)

• Hans-Helmut Kotz (Goethe University / Harvard University)

• Discussion

The Coronavirus Shock: A Look at an Unprecedented Crisis

ONLINEContributors: Robert Boyer (Cournot Centre, Institute of the Americas), Ekkehard Ernst (ILO), Xavier Ragot (OFCE)

Questions & answers

Is It All About Risk? From Life Insurance to Space Surveillance

ESCP Europe - Paris

Speakers:

Nicole El Karoui (Sorbonne University),

George Papanicolaou (Stanford University)

ESCP Europe

79 avenue de la République, 75011 Paris

Room 5119, Building 5, 1st Floor

- More // PDF & Video

-

• George Papanicolaou (Stanford University)

Presentation George Papanicolaou (361 kiB).pdf

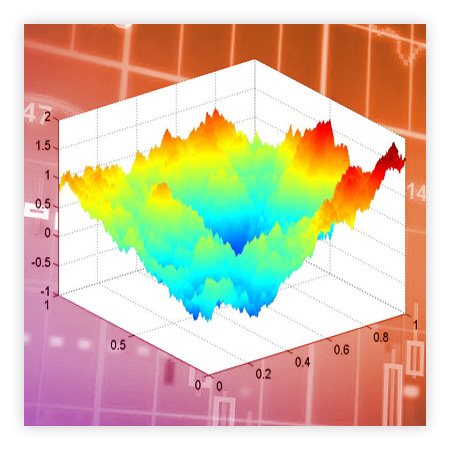

Market Volatility in a Rough State?

OFCE - 10 place de Catalogne, Paris XIVe Organized with the OFCE

Speakers: Nicole El Karoui (Université Pierre et Marie Curie)

Josselin Garnier (Ecole polytechnique)

Mathieu Rosenbaum (Ecole polytechnique)

On financial markets, Brownian-based models have been the most widely used since the establishment of the Black and Scholes framework. These models require numerous calibrations, and their performance is sufficient as long as the data is low frequency (i.e., a few data per day). Over the last decade, with the arrival of high-frequency data, such models have no longer been able to report market observations. Researchers have thus begun looking for new methods. The most promising new path involves building models based on fractional stochastic volatility. This supposes that volatility fluctuation is driven by fractionary Brownian motion, thus introducing memory, correlation and roughness properties.

The question remains as to what these models can do: how to calculate prices, how to create a hedging strategy or how to build a replicating portfolio.

- More // PDF & Video

- • Nicole El Karoui (Université Pierre et Marie Curie)

• Josselin Garnier (Ecole polytechnique)

• Mathieu Rosenbaum (Ecole polytechnique)

Presentation Mathieu Rosenbaum (492 kiB).pdf

HAVE BIG DATA REALLY CHANGED FINANCIAL MATHEMATICS?

Ecole polytechnique campus with :

Nicole El Karoui (Université Pierre et Marie Curie)

Mathieu Rosenbaum (Ecole polytechnique)

Knut Sølna (University of California at Irvine)

Xnovation Center

Ecole polytechnique campus

avenue Coriolis - 91128 Palaiseau

- More // PDF & Video

- • Mathieu Rosenbaum (Ecole polytechnique)

• Nicole El Karoui (Université Pierre et Marie Curie)

Presentation Nicole El Karoui 5-12-2016

• Knut Sølna (University of California at Irvine)

Presentation Knut Sølna 5-12-2016

Would France Be Better Off with Two Germanys?

ESCP EUROPE - PARIS 11Speakers: Robert Boyer (Institute of the Americas), Ekkehard Ernst (International Labour Organization), Baptiste Françon (University of Lorraine), Bernard Gazier (Université Paris I ; Cournot Centre), Xavier Ragot (OFCE)

- More // PDF & Video

- Robert Boyer (Institut des amériques)

Ekkehard Ernst (Organisation internationale du travail)

Baptiste Françon (Université de Lorraine)

Bernard Gazier (Université Paris I ; Centre Cournot)

Xavier Ragot (OFCE)

ESCP Europe

79, Avenue de la République - 75011 Paris

Salle 5119, Bâtiment 3, 1e étage

Métro : RUE DE SAINT-MAUR (LIGNE 3)

https://www.escpeurope.eu

Does Social Democracy Have Economic Foundations?

79, avenue de la République, ParisSpeakers: Jean-Louis Beffa (Cournot Foundation, Lazard), Olivier Boylaud (Spezadenn), Bernard Gazier (Cournot Centre, University of Paris I), Xavier Ragot (OFCE), Udo Rehfeldt (IRES), Jean-Marc Vittori (Les Echos)

- Read More // PDF & Video

-

Presentation Gazier/Boylaud (1.3 MiB)

5 pm – The Microeconomic Foundations of Social Democracy

• Jean-Louis Beffa (Cournot Foundation, Lazard), Bernard Gazier (Cournot Centre, University of Paris I), Udo Rehfeldt (IRES – Institut de recherches économiques et sociales)

6:30 pm – The Political and Macroeconomic Trajectories of Social Democracy

• Xavier Ragot (OFCE), Jean-Marc Vittori (Les Echos)

Redefining Potential Growth

Centre Cournot - ParisRound table with Olivier Boylaud (Spezadenn), Ekkehard Ernst (BIT) et Xavier Timbeau (OFCE).

Europe’s Economic Crisis - Transatlantic Perspectives

Panel Discussions and Book Launch

Washington, D.C.

Chaired by Robert Solow (M.I.T.)

Organized with the Center for Transatlantic Relations, Johns Hopkins University-SAIS, EU Center of Excellence, Washington, DC

Nobel Laureate Robert M. Solow and other distinguished experts discuss Europe’s economic challenges. Will Europe’s economic crisis be remembered as the moment when the EU finally cracked? Or as the spur to a more integrated and competitive Union? What does it mean for the United States? View the new release of the French translation: La crise économique européenne : Perspectives Transatlantiques , edited by Robert M. Solow and Daniel S. Hamilton

- Read More // PDF & Video

-

Welcome and Introduction of New Book

• Daniel Hamilton , Director, Center for Transatlantic Relations

• Robert Solow , President, Cournot Centre

Morning Session I

Europe’s Economic Crisis: Transatlantic Perspectives

• Martin Baily , Brookings Institution

• Hans-Helmut Kotz , Harvard University

• Benjamin Friedman , Harvard University

Question and Answer Session

Morning Session II

Europe’s Economic Crisis: Implications for Europe’s Future

• David Calleo, Johns Hopkins University SAIS

• John Gabriel Goddard , World Bank

• Daniel Hamilton , Johns Hopkins University SAIS

Question and Answer Session

The Feasibility of European Monetary and Fiscal Policies

Johns Hopkins University, Kenney Auditorium, 1740 Massachusetts Ave., NW, Washington, D.C. Organized with Johns Hopkins School of Advanced International Studies

Intervenants: Martin Baily (Brookings Institution), David Calleo (Johns Hopkins), John Gabriel Goddard (World Bank), Dan Hamilton (Johns Hopkins), Jacob Kirkegaard (Peterson Institute), Hans-Helmut Kotz (Harvard University), Xavier Ragot (CNRS), Jérôme Vandenbussche (FMI)

This conference will explore macroeconomic policy coordination in Europe. How well have EU member states responded to the economic crises? How well can they work together to advance structural reforms that can provide the basis for future European growth?

- Read More // PDF & Video

-

Welcome and Introduction to the Conference

• Robert Solow , Président, Cournot Centre for Economic Studies

• Daniel Hamilton , Directeur, Center for Transatlantic Relations, Johns Hopkins University – SAIS

European Monetary and Fiscal Policy: Transatlantic Perspectives

• Martin Baily, Brookings Institution

Presentation Martin Baily (249.4 KiB)

• Jacob Kirkegaard , Peterson Institute for International Economics

Presentation Jacob Kirkegaard (424.4 KiB)

• Hans-Helmut Kotz , Harvard University

• Xavier Ragot , CNRS – French National Center for Scientific ResearchPresentation Xavier Ragot (19.5 KiB)

The Feasibility of European Economic Policies

• David Calleo , Johns Hopkins University – SAIS

• John Gabriel Goddard , The World BankPresentation John-Gabriel Goddard (463.3 KiB)

• Daniel Hamilton , Center for Transatlantic Relations, Johns Hopkins University-SAIS

• Jérôme Vandenbussche , Fond Monétaire InternationalPresentation Jérôme Vandenbussche (43.7 KiB)

Questions and Answers

Appeal: Towards a Common Fiscal Policy: Relaunching the Euro-zone Economies

BerlinJean-Louis Beffa (Saint-Gobain), Gerhard Illing (Ludwig-Maximilians-Universität, Munich), Inge Kaul (Hertie School of Governance), Günther Schmid (W.Z.B.), Robert Solow (M.I.T.)

Towards a Common Fiscal Policy: Relaunching the Eurozone Economies (57.8 KiB)

The Search for a Macroeconomic Policy for Europe

MunichJean-Louis Beffa (Saint-Gobain), Robert Boyer (E.H.E.S.S.), Edouard Challe (C.N.R.S.), Gerhard Illing (Ludwig Maximilian University of Munich), Xavier Ragot (C.N.R.S.), Robert Solow (M.I.T.), Eloïse Stéclebout (European Central Bank)